A Guarantor Mortgage, also known as a Family Guarantee or Family Pledge, is a way of using an additional property to secure a loan which may otherwise not be achievable due to a lower deposit. It basically means the lender will apply part of the loan against another person’s’ property or term deposit – usually from a family member.

How does it work?

The lender will take security over an asset (usually property, but sometimes cash savings) owned by a family member and hold it until there is enough equity in the borrower’s property to remove it (usually when the borrower’s loan is less than 80% of the value of the borrower’s property)

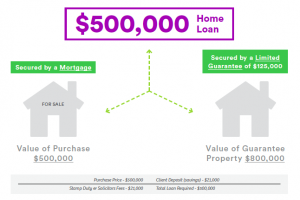

Below is an example;

In this instance, loan amount would be 100% of the purchase price, which is not acceptable to the bank. Without mortgage insurance, the maximum amount the applicant can borrow would be $400k (80% of the property value) – Leaving the borrower $100k short.

The bank would then allow the additional $100k to be borrowed against the guarantors property and can apply a buffer of 25%, making the total guarantee $125k (repayments are only based on the $400k and $100k) The guarantee can then be removed and the asset released when the outstanding amount is equal to the amount borrowed without guarantee – So 80% or $400k in this example. Alternatively, the property increasing in value could also assist in removing the guarantee.

Who can be a guarantor?

Generally speaking, only immediate family members can be guarantors, and most lenders would only allow parents, guardians, or grandparents as guarantors. Occasionally a spouse may be used as a guarantor if it is suitable.

What are the implications for the guarantor?

The primary risk for a guarantor is in the case when the borrower defaults on payments. The guarantor may then be required to assist in repaying the loan, and if they are unable to do so, the bank is able to sell the asset of the applicant, and recover any losses from the guarantor up to the guarantee amount. The guarantee may also impact the guarantor from being able to access equity in their property for other borrowings.

What if the guarantor sells their property?

In the instance the guarantor wants to sell their home, the guarantee must be replaced with cash or an alternate property.

There are inherent risks for the borrower and the guarantor in a family guarantee situation – Legal and financial advice is recommended for any person looking to provide a guarantee.

Applying for Family Guarantees isn’t always straight forwards, so if you’re considering this as a financing option and want to learn more, one of our Peasy brokers would be more than happy to walk you through the process and support you along the way, making it Easy, Peasy.

If you want to find out more about anything you’ve seen here or would just like a chat then drop us a line on hello@peasy.com.au or call 1800 3 Peasy (73279).