It has been widely publicised that Australia’s major banks have begun raising interest rates out of the Reserve Bank cycle, and this is set to continue, especially in the investment and interest only loan space.

So far, NAB have increased their standard variable interest rates for owner occupiers by .07%, and investment loans by 0.25%. This was followed by Westpac’s announcement of an increase by .03% for owner occupiers on principle & interest repayments & .08% for interest only, and .23% for investment principle & interest, and .28% for interest only.

CBA have also advised last month that they would be increasing their interest only investment loans by .12% – this is in addition to a rate increase late last year. ANZ meets once a month to discuss interest rate changes, so we expect to see their change within the next 30 days.

What does this mean for you?

Depending on your loan amount and loan type, your repayments will increase after the effective date of the rate change.

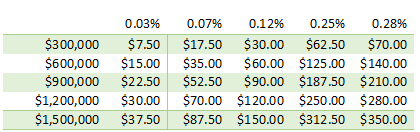

Below is a table of how your monthly loan repayments may be affected by the change (based on interest only);

If your rate has been affected, your lender must advise you by your preferred contact method (email or mail) prior to the date of the increase.

What are my options?

Any decision you make from here should be carefully considered and discussed with your broker, although there are a few ways you can limit the impact of these rate increases;

• Fix your loan in – There are still a number of lenders who are offering very competitive fixed rates in the market place for both investment and owner occupied mortgages. If you are interested in looking at these options, please inform us and we will give you some options.

• Move to another lender – Some of the non-major banks have signalled their intent to keep writing business at competitive rates. We can give you an idea of some of the rates available.

• Renegotiate with your current bank – Sometimes a quick call to your bank (either by us or yourself) can help with getting a discount on your loan, especially if your loan hasn’t been reviewed in the past 12 – 24 months.

• Change the repayment or loan type – if you no longer require interest only repayments, or if you are now living in your investment property, we can switch your loan to an owner occupied and/or principle & interest loan.

The changes above can have many implications, so let us know if you are considering either of them and we can talk you through the potential benefits and pitfalls of each to find the most appropriate option for you.

Of course, if you need anything at all, we are just a phone call or email away.