Dear Valued Clients,

As the Easter long weekend draws to a close, many of our clients who would normally spend their time away with family and friends, have found time to sit and review their finances and look at what options they might have in front of them once the craziness of COVID-19 is over… And so the million-dollar question comes up…

“is now a good time to buy?”

It’s a question we get asked on many occasions, although none more so than when we are facing times of economic uncertainty, with some arguing that the economic fallout from COVID-19 could have one of the most significant impacts on our economy ever recorded. The answer to this question is usually a set of questions in return – Which market are you considering? Is it a home or an investment? Can you afford to buy your ideal property? Are you as certain as possible that your income will continue for the foreseeable future?

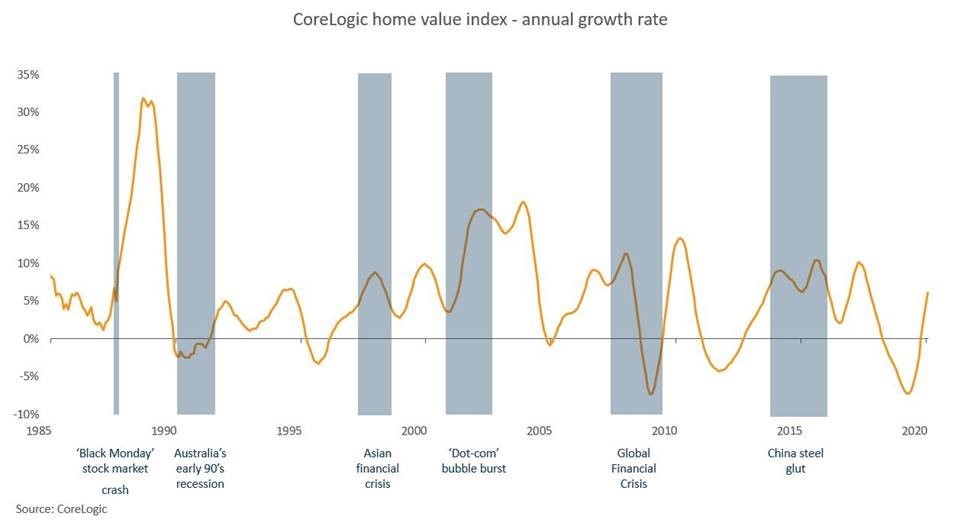

Historically speaking, property prices have not been as significantly impacted by global recessions and economic across Australia as it has done the rest of the globe and instead tend to run largely at their own pace as you will see in the image below;

The orange line follows market movement and as you can see it is largely above 0% rather than below. This means property prices are generally increasing the majority of the time, even in most cases when a “crisis” occurs. In fact, when a large decrease in property prices occurs, it is generally followed by a large increase in property prices, as you’ll see towards the end of the GFC as well as early 2019.

The important thing to remember is that the finance industry in Australia is heavily regulated, particularly when compared to the rest of the world. For example, the GFC had a much more significant impact on the US property market as property owners could obtain a home without a deposit or verified financials and simply hand the keys back when it doesn’t work out. Someone who has invested $100k into a property here isn’t simply going to walk away from their property without a fight, so they will do everything possible to keep it!

As an investor it’s simple – pick the right time to purchase a property to ensure you can maximise your gains. This can be over a short period of time if you are hoping to gain equity for further investments, or over the long term to build wealth. You ideally want to be one of a very few people buying a property to ensure you can negotiate the best deal possible, and these times are almost always during economic uncertainty. “Knowing” that property prices rebound after a significant drop, this would suggest that your time to buy is very soon. Also, “knowing” that the period of time that property values decrease is only a short period of time (around 6 – 12 months), it would make sense to be ready – not just now, but always. This means your deposit ready and preapproval in hand, and making offers whenever you see a good deal. As to whether to buy right now or not, I believe it really depends on the deal you are getting. If you can buy under current market value based on your research, then why not. It could take a month or two of this pain we are experiencing before the market falls as a whole though (assuming it does), so whilst it’s important to be ready, you should also be patient.

As a home buyer, the answer is a little more complicated as there is an emotional aspect that cannot be measured in numbers and graphs. We see the heartbreak of our clients who attend auctions and open homes Saturday after Saturday only to find out that their maximum price wasn’t even enough for the opening bid. A home purchase is an emotional transaction so it’s natural to want to buy when the market is hot. The fear of missing out is real, especially when you watch the 6 o’clock news telling you house prices are out of control. Conversely, when you’re the only person at an open home there is an understandable feeling as though the timing might not be right. Although, when you’re one of 50 groups at an open home, it’s natural to feel rushed and compelled to make an offer as soon as possible. This can lead to ‘paying too much’ for a property or buying a home that is only suitable for a short period of time, or not suitable at all.

There is no doubt that buying during these uncertain times comes with its risks, although as long as you can afford the property you are looking to buy – not just now but in the long term; and the property is suitable for you for a good period of time (i.e. you’re not going to have to upgrade in only a few years), then really, anytime is a good time to buy. There is no doubt though that securing a purchase in the next month or so is more likely to yield a better long term result (historically speaking) then waiting for the hype to start picking up again. Those other 50 buyers at that open home you went to only a few months ago didn’t find properties overnight, and no doubt they are waiting for the ‘right time to buy’ as well. You just need to make sure it’s not at the same time you’re looking to buy!

Now more than ever it’s important to make sure you complete a rigid budget being as conservative as possible. Think of all the “what ifs” and come up with a game plan to counter those as well. If you’re relatively certain your job and income is safe and you have savings to cover you in case this changes, then I believe it’s absolutely a great time to proceed, albeit with plenty of caution and an eye for a good deal. It might be a month or two before potential sellers have some sort of idea of what the following few years looks like, so deals could become available and you might be one of the ‘lucky ones’ that got in at the bottom.

Of course, if you have any questions on anything I’ve mentioned above or would like to discuss anything else, feel free to get in touch: 1800 3 PEASY.