Did you know that while surveys indicate most Australians want to own their own home, the latest available data shows only 66% of households do?

The federal government’s promise of higher property price caps for new buyers under the Home Guarantee Scheme will help to open up further opportunities and give first-time homebuyers some extra leverage to enter the housing market sooner.

How does it work?

In its current form, the FHLDS allows eligible borrowers to take out a mortgage with a deposit as small as 5%, without paying lenders’ mortgage insurance. This is done by the government by guaranteeing up to 15% of the loan.

Previously the scheme was capped at 10,000 places with last year’s scheme running until June 30, 2022. From July 1 for the next financial year, the number of places will expand from 10,000 to 35,000 places, plus an additional 10,000 places for homebuyers in regional areas.

The scheme is broken down into 3 categories:

- 35,000 places to first home buyers looking to purchase a new or existing home (FHLDS)

- 10,000 places for first home buyers and previous homeowners in regional Australia (Regional Home Guarantee)

- 5,000 places per year for single parents looking to purchase their first home or re-enter the property market (Family Home Guarantee)

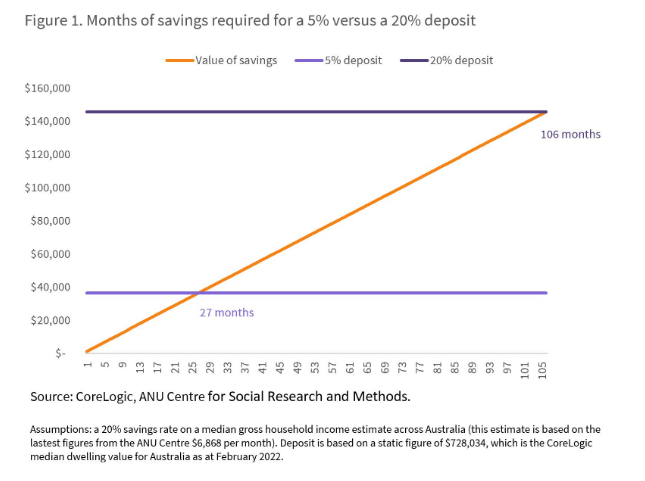

The scheme would mean it would take roughly a quarter of the time to save a deposit. This could cut 6.5 years in the rental market for first home buyers – currently, weekly rent values on the median dwelling in Australia equate to almost $160,000. The savings on Lenders Mortgage Insurance could be upwards of $30,000 on the median Australian dwelling value with a 5% deposit.

Saving to buy a house has become harder with increased prices. The scheme will cut years off the time you would need to save a deposit for a home. More Australians will have the opportunity to be part of homeownership.

Am I eligible?

To be eligible for the scheme the main criteria are:

- Australian citizens who are at least 18 years of age

- Applications are limited to singles with an income of up to $125,000 or couples with $200,00. Purchases under the scheme are limited to between $350,000 in some regions, to up to $950,000 in Sydney for new homes.

- Couples are only eligible for FHLDS if they are married or in a de-facto relationship with each other.

- Applicants must intend to be owner-occupiers of the purchased property. Investment properties are not supported by FHLDS.

How do I apply?

Whilst the number of places available in the scheme has been expanded, some experts are predicting that demand will still substantially out-strip supply.

If you are eligible and would like to apply for these schemes we can help you track down a lender with available places.

How does this affect me if I’m an investor?

There’s no doubt property prices have been increasing across the country at unprecedented levels, and as an investor, it may feel as though “the horse has bolted” and there may be little to no opportunities remaining. However, affordable locations still appear to be holding their own even whilst some parts of Sydney and Melbourne are slowing or even dropping, and increasing the price caps in those areas, plus the number of spots available, should get some more interest from home buyers.

Rental yield typically does end up a little better as well due to the high rental demand and more affordable prices, so It’s a little easier to hang onto those properties, even if the growth is slowed. We believe the affordable locations are where it’s at for investors, and with further government, assistance focused on helping buyers get into their first home sooner in those areas should help underpin their values.