We are seeing signs of house price growth easing in the Sydney and Melbourne market, and the property market correcting to a more “normal market”, which is welcome news to buyers.

FOMO has disappeared in the Sydney and Melbourne markets, with more properties coming into the market since the end of last year’s lockdowns. More choice will mean buyers are not making hasty decisions and are being more discriminating about what’s on offer.

Subsequently, the imbalance has been redressed – we have a buyer for each seller, rather than numerous buyers willing to overextend themselves to win the competition for a property.

There is now a more even playing field where buyers and sellers can negotiate a position, whereas before we had a surplus of buyers and hardly any stock on the market, creating a buying frenzy so only the seller had a chance.

What does this mean for sellers?

Sellers will need to adjust their price expectations and bear in mind it will take longer to sell their property and with fewer competing bidders.

One of the common theories is, that as interest rates begin to rise, and home buyers’ borrowing capacity decreases, housing demand will reduce further.

However, we’ve seen wage increases easily cover the rate increases from an affordability and borrowing capacity standpoint, and think that it’s more the placebo effect of the rate rise that’s causing hesitation.

Either way, homeowners will likely be facing fewer, but more empowered buyers exerting more pressure and therefore will need to be prepared to meet them in the middle.

Watch out for the savvy buyers who tend to strike when and where no one else is looking!

The question I get asked at times like this is, “when and where will the bottom of the market be?” I think the question that should be asked is, “can I afford the property I want now and in the long term, and is that particular property available now and in my price range?”

The market will always be susceptible to rises and falls, but in 10-15 years, it’s all going to come out in the wash.

How did the property market fair in May?

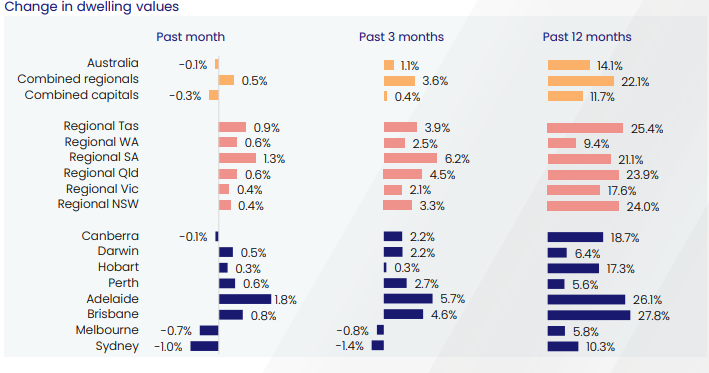

A combination of higher interest rates, rising stock, and lower consumer sentiment has dampened conditions in the market. Australian home prices fell by 0.1% nationally for the first time in at least 20 months according to CoreLogic, with Sydney leading the decline -by 1.0%; Melbourne -by 0.7%, and Canberra -by 0.1%.

Brisbane, Adelaide, and some regional areas are bucking the trend and continue to show price growth (in certain areas).

Corelogic, June 1, 2022

Corelogic, June 1, 2022

The national auction market reported a clearance rate of 63.8% last weekend, which was lower than the 71.4% reported the week before, and also lower than the 82.2% recorded over the same weekend last year.

Higher listings have added to tougher selling conditions resulting in lower auction clear rates for the 2 main cities – Sydney at 62.8% and Melbourne at 62.9%. While Adelaide remains strong with a clearance rate of 79.4%.

Even though the market is tipping towards buyers, there is still not enough good properties for sale to meet the strong demand for houses in Sydney, particularly in the middle-ring affluent suburbs.

So, it’s not all doom and gloom for sellers – even though Sydney housing values are down – by 1.0%, remember housing values are still 22.7% above pre-COVID levels.

We are now starting to see the property market correct itself after unprecedented growth in the last 2 years.

And getting ready for the next “new normal”!