As you may have seen, the RBA decided to decrease rates today by a further .25% – the third decrease by the same amount this year.

In line with the previous rate decreases, we will be sure to update you on what each bank is doing in terms of passing this on and you can expect these emails over the coming days, but what does the most recent rate decrease mean for you?

- Lower repayments

Depending on how much the bank passes on, your repayments should reduce by a noticeable amount.. The following is an example of how your loan repayments are likely to reduce based on principal & interest, and interest only loans;

– Principal & Interest (based on a 25 year loan term);

| Loan Amount | Difference per month |

| $500,000.00 | $70.35 |

| $1,000,000.00 | $140.71 |

| $1,500,000.00 | $211.06 |

| $2,000,000.00 | $281.42 |

| $2,500,000.00 | $351.77 |

– Interest Only;

| Loan Amount | Difference per month |

| $500,000.00 | $104.17 |

| $1,000,000.00 | $208.33 |

| $1,500,000.00 | $312.50 |

| $2,000,000.00 | $416.67 |

| $2,500,000.00 | $520.83 |

*Please note.. Not all lenders will automatically reduce repayments on a principal & interest loan. You can call your bank to have this reduced for you, or alternatively leaving the repayments as is will help you pay off your home loan quicker and save interest..

- Higher borrowing capacity

Much like the property boom of 2012 to 2017, a lower rate will now mean a higher borrowing capacity in a lot of cases due to recent APRA changes.. This borrowing capacity increase could be as high as, and in some cases excede 5% depending on the lender and how much they pass on..

So, what does this mean for property prices in Sydney?

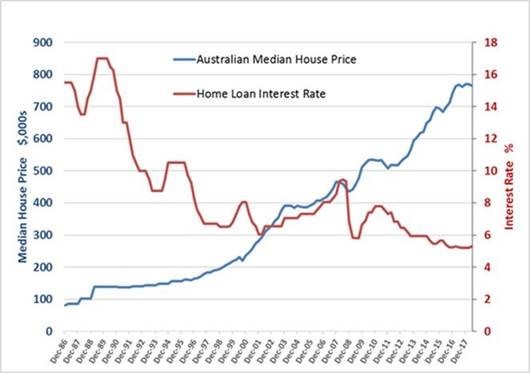

If we look at previous trends, interest rate decreases tend to follow a very similar pattern to home values.. As the rate goes down, property prices go up.. See image below;

This tells us that if Australians can afford and borrow more, they pay more for property.. The property price drop in 2017 was directly related to the increased regulation by APRA where the assessment rates were increased, although as of early this year these rules were loosened and we now are back to a similar method of assessment rate controls to the boom…

Purely based on this, we believe property prices will continue to rise at a steady rate in Sydney, although we certainly don’t expect there to be a repeat of the boom of 2012 – 2017 due to other market factors and limits on borrowing capacity through other control methods..

Of course if you have any questions or would like to discuss, feel free to give us a call: 1800 3 PEASY!